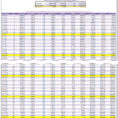

Using a Home Loan Comparison Spreadsheet For Finding the Best Rate

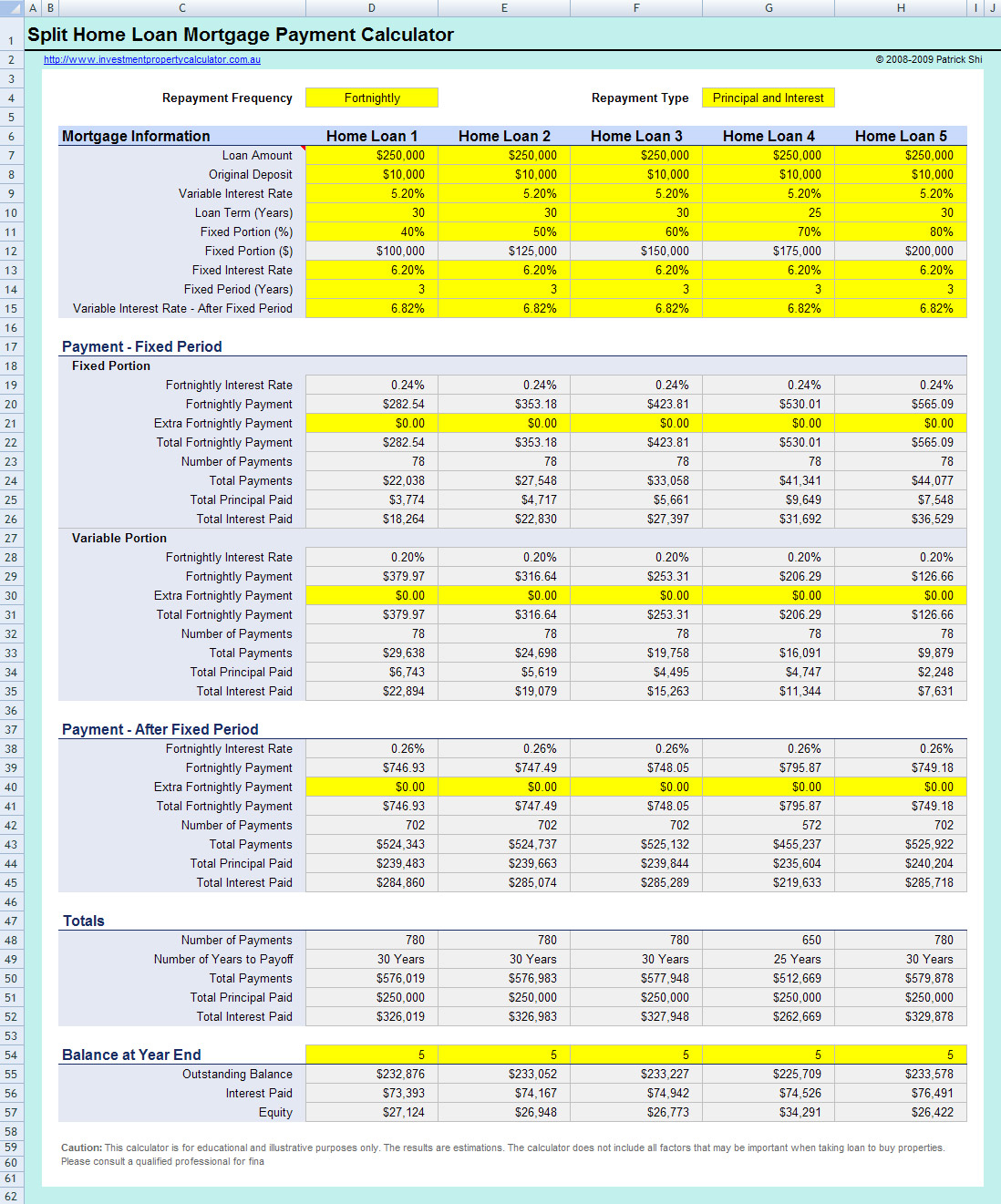

Home loan comparison spreadsheet can be used for finding the best rate for you and your family. Make use of a home loan comparison spreadsheet if you want to find the best deal for your monthly mortgage payments.

It’s likely that you’ve spent quite a bit of time looking for the right home for yourself and your own home, only to find out that there are actually a few factors you need to consider before buying. A good home loan comparison spreadsheet can help you find the ideal solution for you.

If you’re ready to buy a new home, you’ll want to do some research about it. However, getting a home loan is going to be much different from just getting an unsecured personal loan, so you have to make sure you’re aware of the differences as well. If you don’t take the time to do a good home loan comparison spreadsheet, you could find yourself paying a lot more than you need to.

It may be hard to think of what type of loan you might like if you haven’t even taken the time to compare loans that are available. There are several types of loans available, and you want to have a good idea of what kind of loan you want to choose from so you don’t end up paying too much money.

If you’re looking for a good way to find the best loan, it’s a good idea to use a loan comparison spreadsheet. This is especially important if you don’t have a lot of experience with loans or have no idea what you want to do.

You will want to consider these things when you find the loan you are looking for:

Your annual income: You need to check how much income you’re making each year to see how much money you’ll need to pay each month on the mortgage. Your salary should be lower than the mortgage payment amount to keep you from having to pay an excessive amount of interest each month.

Current credit score: You also need to find out what your current credit score is and if it’s lower than you would like it to be. If your credit score is high, you might not want to borrow from a very high interest rate because it could damage your credit score.

First and last months of payment options: These are the terms of your loan contract, and these will vary depending on the lender you choose. Most lenders will offer the option to extend the term of your loan for a fee, but you can also find out what they can offer if you look into the options offered.

Applying for a loan through a non-profit organization: These are nonprofit organizations that can often offer loans at very low interest rates. You can find out if they are lending through their website or call them for more information.

These are all things you will want to know about a home loan. Using a home loan comparison spreadsheet can help you find the best deal, and you’ll have more money left over to spend in your budget each month. SEE ALSO : home construction estimating spreadsheet

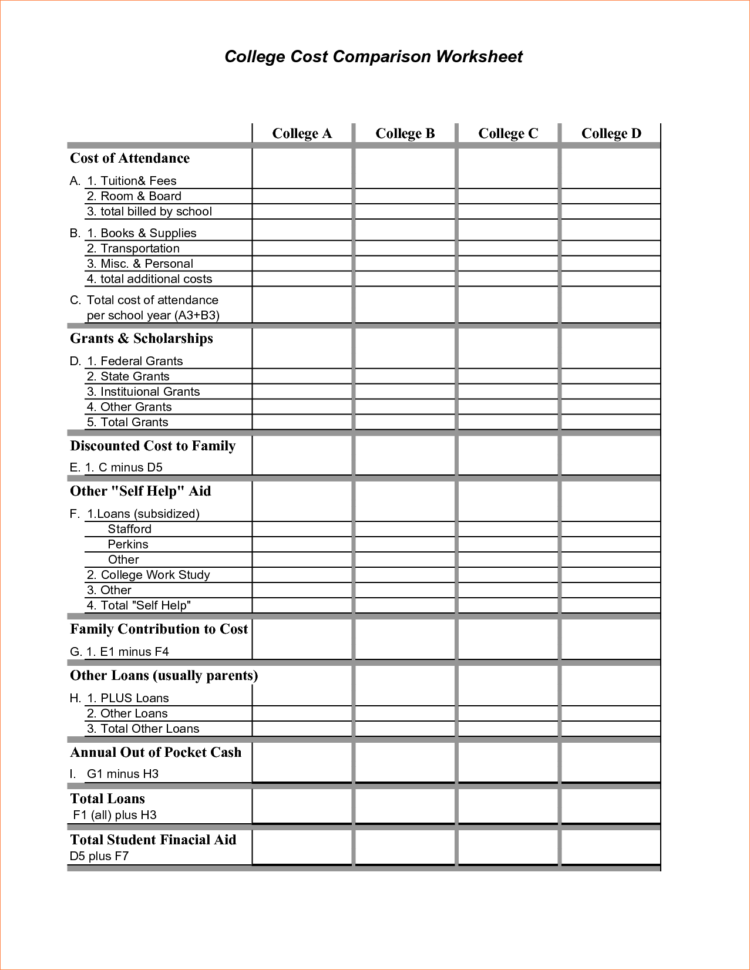

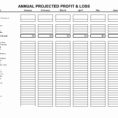

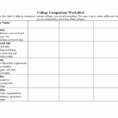

Sample for Home Loan Comparison Spreadsheet