Some people may find the concept of General Labor Invoice a little too far-fetched, but the concept is actually one of the most cost-effective business tools in existence. In a nutshell, it’s an invoice that outlines how much a worker is expected to work. The terms of the invoice are also important to consider, because they determine how much tax the employee will pay on the amount they are actually owed.

Some employers try to avoid paying employees tax payments altogether by employing lower-paying employees who are not entitled to any benefits, such as health insurance or sick leave. Employees with higher tax rates usually end up paying more for their benefits, and that means their employer can claim a credit against the amount of taxes that the employee owes. A worker who knows that they will not receive paid sick leave or the benefit of a health insurance plan can often be driven into bankruptcy or having to file for bankruptcy.

To help workers overcome the problems created by the tax code, the Department of Labor has issued guidelines for the creation of a General Labor Invoice. These guidelines have two main points. First, it tells employers how much they must include in the invoice; and second, it tells employees how they can take advantage of the tax credit against their taxes. Here are some tips on how to create your General Labor Invoice.

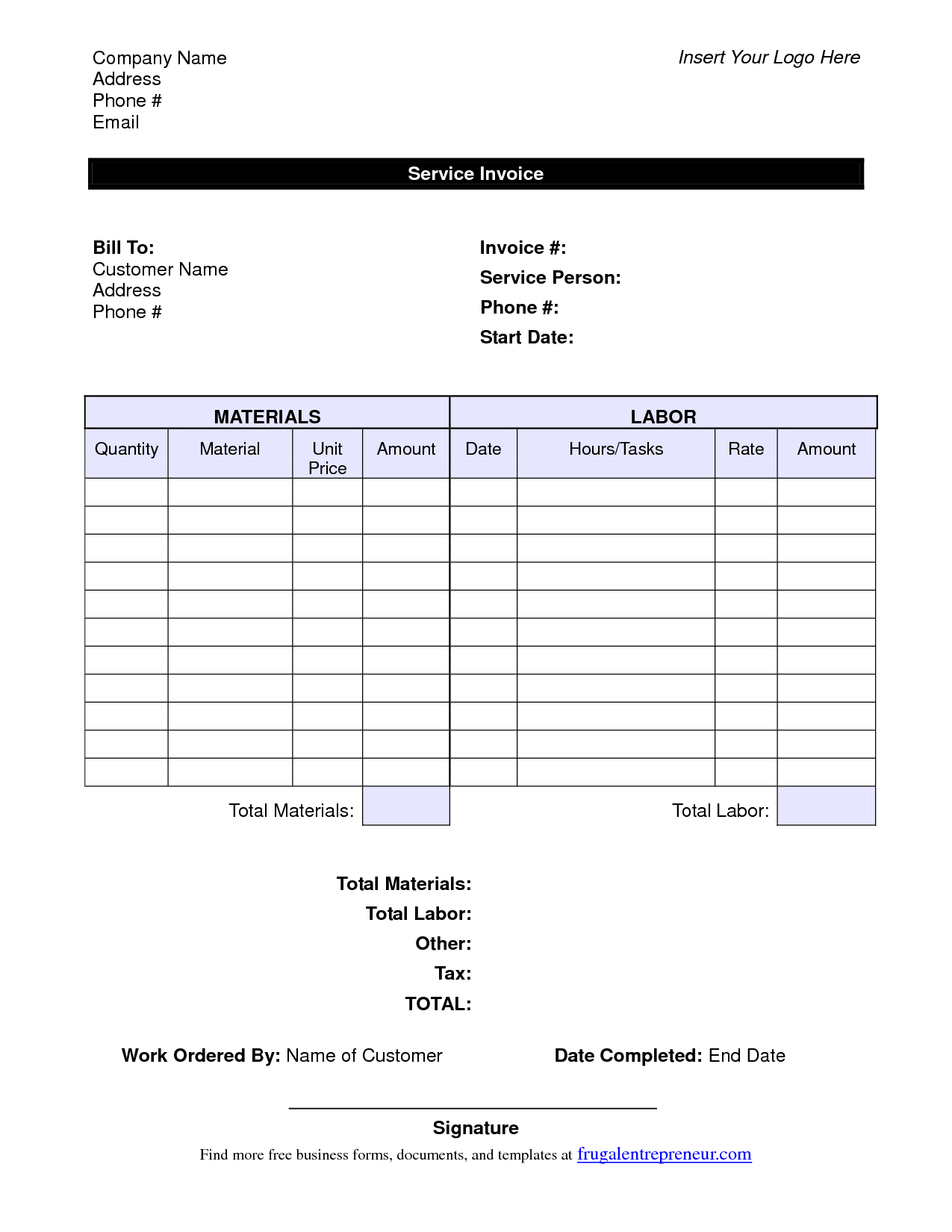

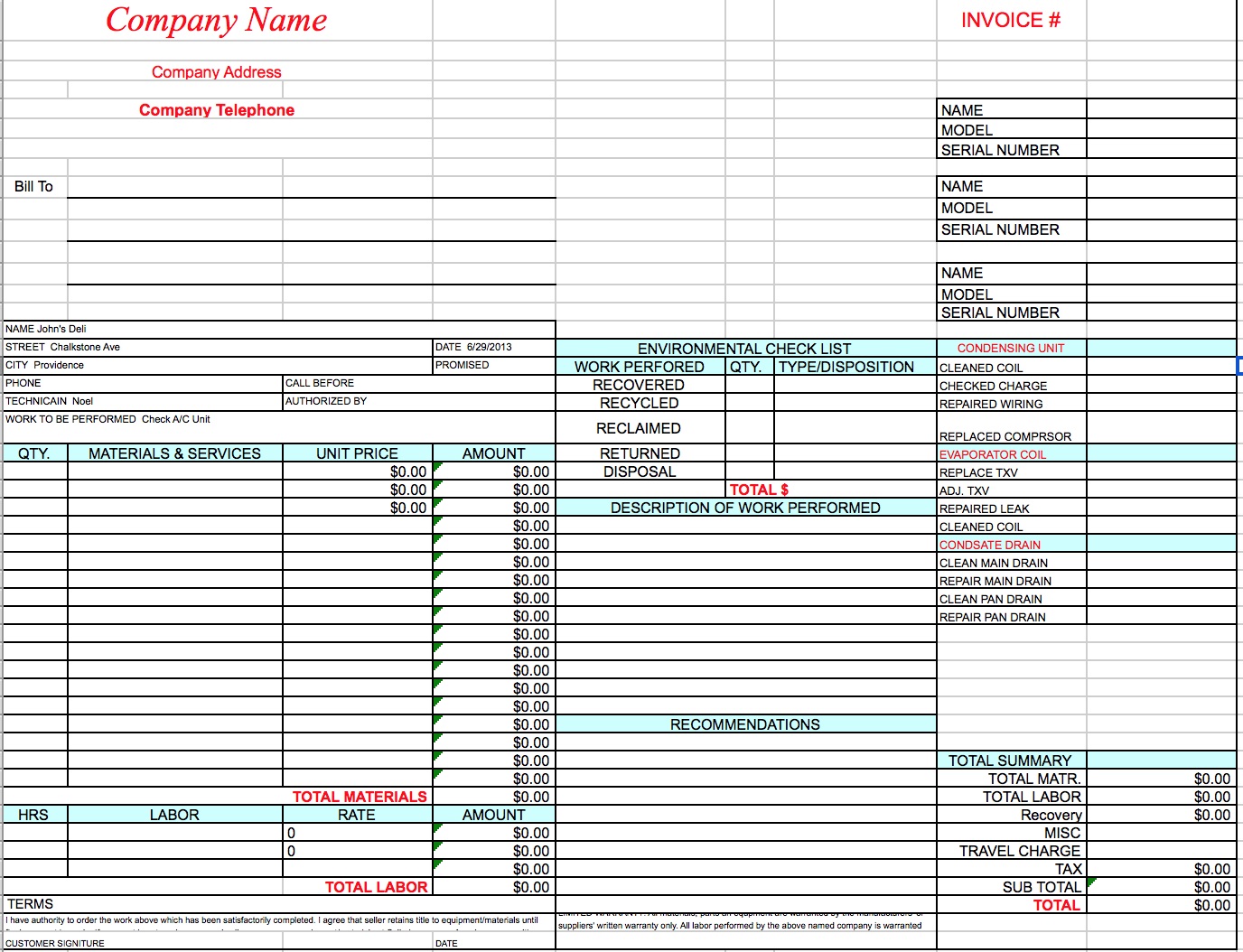

General Labor Invoice

The first thing you need to do is compile all of the relevant information regarding the employee’s job, including the job title, duties, salary, hours worked, and tips received. Make sure that you also include other factors that impact an employee’s work, such as holidays, vacation days, or training.

When preparing the invoice, make sure that all of the workers listed are properly classified according to the job. A payroll clerk needs to be classified as a “manager,” a laborer as a “worker,” or a cook as a “cook.”

Also be sure that the classification of the worker matches their pay grade, their duties, and the unit that they are working in. Sometimes, it’s hard to tell the difference between one worker and another without clear data to compare their pay, which is why it’s best to get input from all of the workers involved.

Once you have all of the workers in their correct roles, summarize the duties that are required to complete the project, how long the project will take, and complete details on how many hours the worker should work. Be sure to keep the number of hours worked low enough so that you don’t encourage underpayment, and that you leave room for flexibility if the worker’s position changes.

Schedule the work in order of priority, starting with the higher-priority projects and going down from there. You can have the invoice spell out all of the steps involved, but it’s much easier to just list the project on a timeline. Of course, if the worker believes that they’ve been overworked, you can also list a specific reason why they were overworked, but this should not be the entire description of the process.

After detailing how much the worker should work, you should also provide them with details on their health insurance plan. Even if the worker does not currently participate in a health insurance plan, you should provide them with a plan. If the worker doesn’t think that they’re eligible for such a plan, be sure to provide them with options that could save them money.

Last, before you send the invoice to the Internal Revenue Service, you should have it cleared through the IRS and sent to each worker. This is just to be sure that everything is complete and accurate, but you should also make sure that the IRS can see the details of the invoice. Payroll clerks and other employees might have to produce certain documents for the IRS before they can process the invoice.

With these steps, you should be able to create a General Labor Invoice for your workforce. When you send the invoice, be sure to include all of the necessary documentation and include an explanation of any reasons why the invoice isn’t paid. Remember, a good General Labor Invoice lets employees know what their responsibilities are in a timely manner and that they are at least paying their fair share of taxes. PLEASE SEE : free business expense software