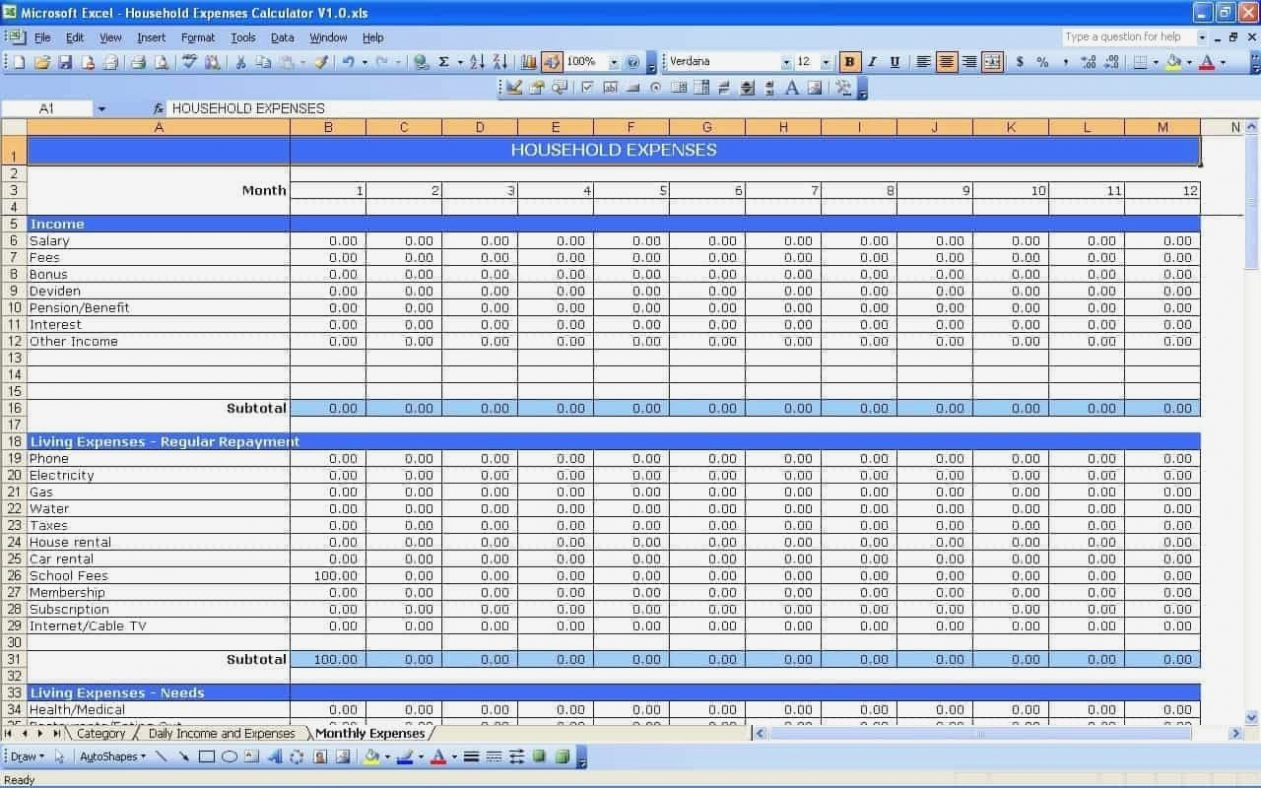

Back To Expenses Spreadsheet Template For Small Business

Related posts of "Expenses Spreadsheet Template For Small Business"

Excel Spreadsheet Validation For Fda 21 Cfr Part 11

It's easy to see why more companies are looking to use FDA 21 CFR Part 11 certification as a way to go about promoting their products or services. In the public and health insurance markets, much of the quality comes from being a member of an appropriate insurance regulatory organization, such as the National Association...

Spreadsheet For Cow Calf Operation

Spreadsheet for Cow Calf Operation - an in Depth Anaylsis on What Works and What Doesn't With time, the spreadsheet grew into that which we see today, in the sort of Microsoft Excel and lots of similar goods on the marketplace. It's possible that you name your spreadsheet everything you would like. So you've got...

Bar Inventory List Template

Bar Inventory List Template - 3 Steps To Always Know What You Have A bar inventory list template is essential for anyone who owns and operates a business, from small bar locations to large corporate entities. This list is a key to reducing expenses and making room for extra inventory in areas where they're usually...

How To Create A Business Expense Spreadsheet

Most home based business owners do not have to worry about how to create a business expense spreadsheet. After all, most of the expenses are for company business costs and not personal expenses. However, there are some expenses that belong in the personal category and should be reported on a separate line. The first thing...