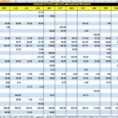

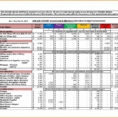

Excel Spreadsheet For Splitting Expenses With Split Expenses Spreadsheet My Spreadsheet Templates

If you don’t have spreadsheet software, you may download some versions at no cost or utilize an on-line edition. Bear in mind, most vendors will tell you their software is simple to use. Things to search for in a household budget You will need to keep a look out for a few things, as you hunt for the perfect household budget software to use.

Back To Excel Spreadsheet For Splitting Expenses

Related posts of "Excel Spreadsheet For Splitting Expenses"

Convert PDF to Excel Spreadsheet - How to Do it This article is about converting PDF file to Excel spreadsheet. It will show you how to do it and will also teach you a few ways to save your time. Here are some tips on how to make Excel spreadsheet from PDF files. The first...

The Ultimate Manual to Spreadsheet App Spreadsheets in business is going to be the new smoking. Because it is a spreadsheet, you can do anything you want. There's a means to carry on using Excel spreadsheets! If you just use the Excel spreadsheet, you're definitely stuck previously. Transforming your Excel Spreadsheet into a cell app...

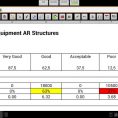

Key Pieces of Bowling Handicap Spreadsheet Ideas, Formulas and Shortcuts for Bowling Handicap Spreadsheet. All you need to do is pick and choose a template which goes with your goal. Once you do this, you may download the template and customize it according to your requirements. The best thing about those templates is they can be...

Asking the question how to make a debt snowball spreadsheet can be very useful when it comes to drafting up a budget and tallying up how much money you have to work with. For example, it will help you keep track of all your debts and try to stick to your budget. You do this...