The Pain of Debt Avalanche Spreadsheet

Keep in mind, you’re never going to pay off your debt if you only sit there comparing plans. Paying off debt is quite a tough job to reach. The first thing you should learn how to do is stop creating new debt.

There is really a mathematically correct means to pay off debt. Paying off a debt is a substantial accomplishment and it helps build your confidence on being in a position to manage your debt reduction program. When you opt to quit creating new debt, attempt to concentrate on the long-term advantages.

How you opt to begin paying off debt is dependent on your unique conditions and how your mind really works. Therefore, it’s very feasible to pay off your debt, but nevertheless, it will take some sacrifice and attention. You start with paying off your smallest debts, continuing to the bigger ones.

If you would like to escape from debt faster, then you will need to maximize your surplus. The great thing about paying off debt is that you are able to create any method which works for you. If you cover the biggest debt first, it is going to have a very long time before it is possible to observe the fruits of your labor.

Bear in mind, you’d have to earn a minimum payment on all your debts every month. If a promotional rate of interest ends, you might have to reorder your debts to continue to keep your focus on the one with the maximum rate. Now that you’re attempting to pay down debt, it should grow to be a top priority, Woroch states. Most individuals think that you have to pay off your most significant debts first if you would like to be debt-free.

The Fundamentals of Debt Avalanche Spreadsheet Revealed

If you aren’t mindful of how you’re spending your funds, odds are you won’t ever be in a position to escape debt. When you owe money to different creditors, it is simple to feel like you’re sinking in a sea of debt, and it’s tough to receive your head over the water. As soon as you see where your hard-earned money is going, you are going to be in a position to establish a budget which works and begin tackling your debt.

Definitions of Debt Avalanche Spreadsheet

You may feel as if you’re trying hard to pay off all your debts. Debts are extremely overwhelming, especially in the event you have a great deal of those. Eventually, you’re pay off that very first debt.

You might know about the debt snowball method, but there’s another means to pay down debt you might not be acquainted with. You may then compare numerous forms of debt side-by-side, and prioritize a payment plan based on each a the maximum rate of interest or lowest beginning balance. When it has to do with paying off debt, the initial step is to produce a budget and prioritize your payment program. You won’t have the ability to cross off your debts one by one in a brief quantity of time.

Whether it’s possible to refinance your debts. Debts can be exceedingly stressful. By way of example, let’s assume you have three debts you’re attempting to pay off. Even though it might appear daunting, it’s important to know the complete quantity of debt you owe. Whenever your first debt is totally paid, the rest of your snowball is subsequently applied to the NEXT debt, etc, until all the debts are paid.

You’re able to pay off your debt even faster by utilizing extra money to pay off your debt. Both are utilized to target a single debt at one time as you pay the minimum on all others. Consistently paying off debts in time may have a positive effect on your credit ratings.

What to Expect From Debt Avalanche Spreadsheet?

If that’s the case, then you may want to try out the debt snowball process. While Debt Snowball is really very good at eliminating debt, it isn’t the optimal method. Although avalanche could be your cheapest and most logical route to becoming debt-free, you might have to wait a while to feel the triumph of zeroing out a debt particularly if your highest-interest debt is likewise the largest. The debt avalanche method can be a bit slow to provide that. It is a type of debt payoff plan.

The War Against Debt Avalanche Spreadsheet

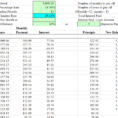

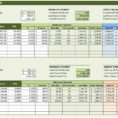

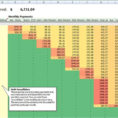

What’s perfect in a spreadsheet may not be perfect in our day-to-day life. The spreadsheet includes a complete set of directions that it is possible to follow to fill it out yourself. Such spreadsheets may be customizable.

The Definitive Strategy to Debt Avalanche Spreadsheet

If you would like to make faster calculations, you may use a debt snowball calculator. You are able to use an on-line calculator that compares the debt snowball and debt avalanche methods to figure out how much time it will take to escape from debt and find out how much interest you will pay over time. Then you could also use a debt reduction calculator to produce calculations when planning.