Credit card rewards programs are there to reward good customer behavior. However, it is the amount of interest that accrues on these rewards programs that is the problem.

Rewards programs reward consumers for not making use of their cards. For example, if a credit card rewards customer for paying the minimum balance each month, and he or she does, the credit card rewards program is actually rewarding that customer for missing two payments. The system rewards him or her for using the card once, but rewards it for not paying the minimum balance each month.

If you use a credit card rewards program, you will be rewarded for using it one time. You could spend hundreds of dollars, or even thousands of dollars on a single purchase, only to see the credit card rewards program lose money because you didn’t pay the minimum monthly payment.

Credit Card Rewards Programs – How Do You Compare Which One Works Best?

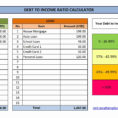

If you want to know how much interest you will pay on your credit card rewards program, the best thing to do is to add up all the credit card rewards programs that you currently have and the interest that you will accumulate. See which credit card rewards program has the highest total interest rate. Then subtract the interest rate from the total and compare it to the total amount of your overall balance.

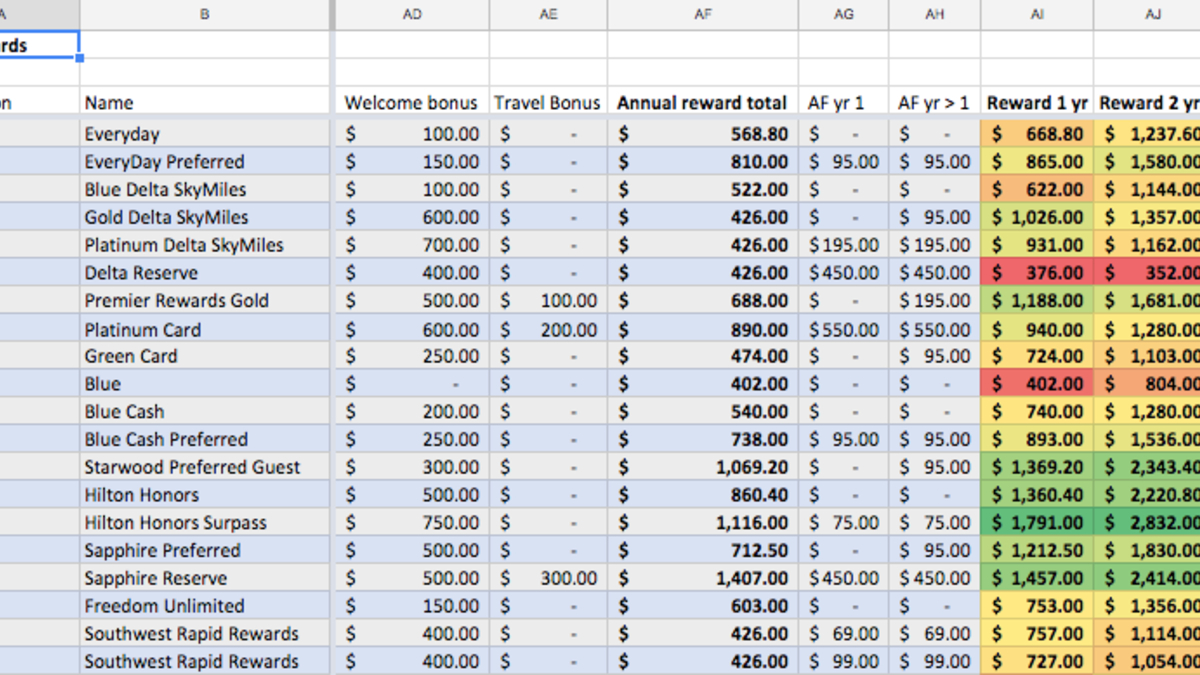

For example, let’s say that you are a credit card holder with a Chase credit card. There are two credit card rewards programs available to you – Chase points and Chase purchases. If you go for the Chase points program, the Chase purchases program would appear as the final figure in your spreadsheet.

The chart shows that you will end up paying twice as much interest if you use your Chase points card to pay your Chase purchases. You will end up paying over two thousand dollars in interest. Your chart also shows that you will end up paying five hundred dollars in fees every year. This is a five hundred dollar payment every year that you will never have to pay.

In reality, you are rewarded for being a good customer. Your rewards program will reward you for being a good customer, and it will reward you for not paying your minimum balance every month. The choice is yours.

The chart illustrates that the most important factor when comparing rewards programs is the rate of interest you pay on your total balance. By calculating the total interest rate for your card, it shows you what you will have to pay every month to service your credit card balance. That is the only factor that really matters, and the most important factor to your total balance.

Using the chart, it is easy to see which credit card rewards program has the lowest total interest rate. It is the Chase purchases program. You are given the choice of which credit card rewards program you want to pay off first.

There is no need to use your own spreadsheet to make this decision. Instead, just input the total interest rate and choose the rewards program with the lowest total interest rate.

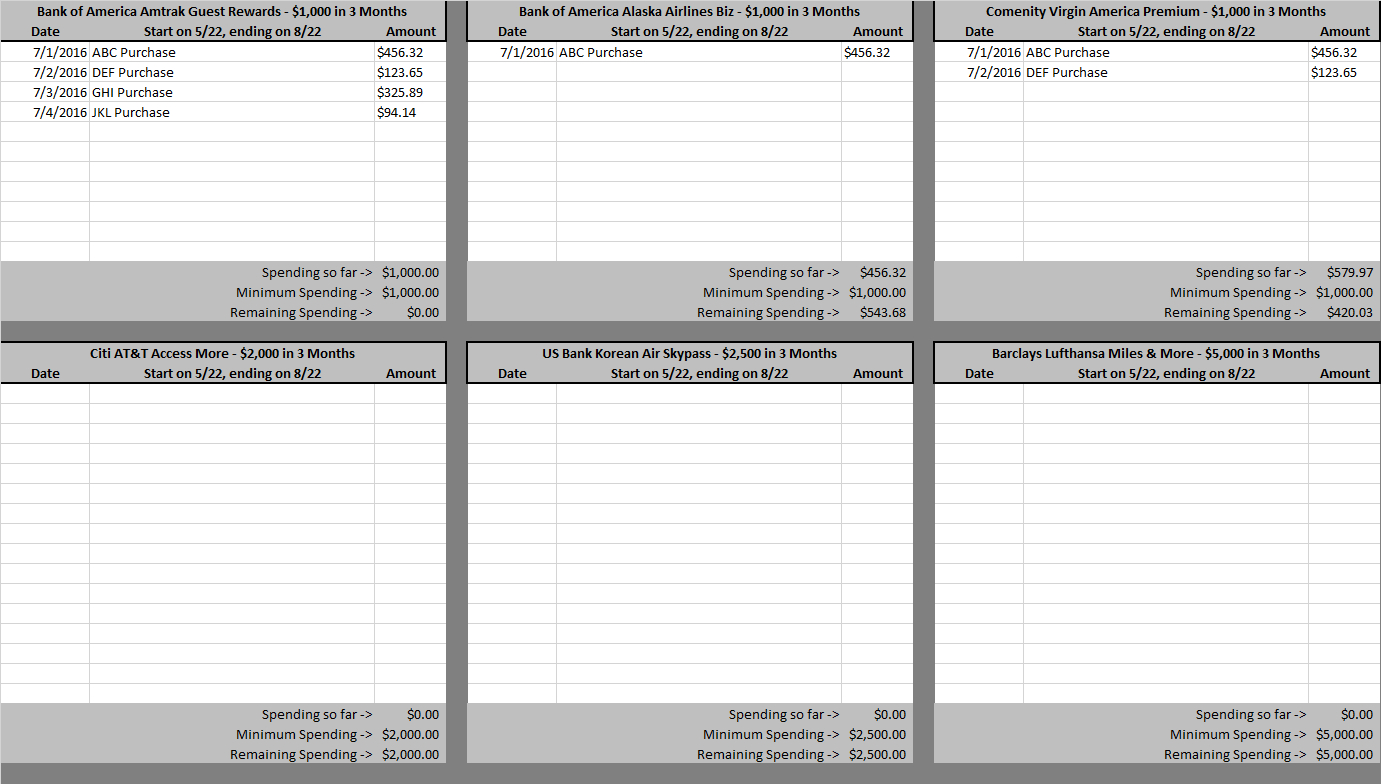

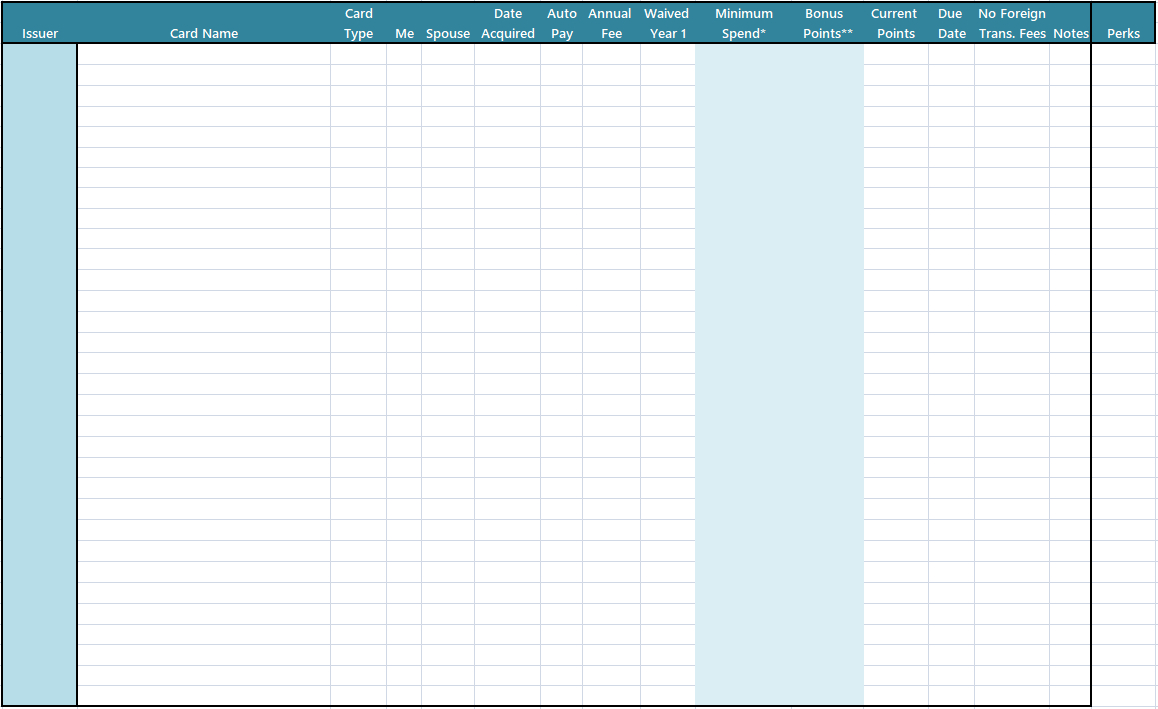

If you don’t have your own spreadsheet, you can get one online. Most of them provide an option to input your total balance and then add in the rewards for each category.

Once you enter your own balance and rewards information into the spreadsheet, you will see that you have to choose which category gets the best reward. In the end, your choice between the rewards programs should come down to the interest rate and the fees. By using your own spreadsheet, you can accurately choose the reward programs that are right for you. PLEASE READ : credit card repayment calculator spreadsheet