An auto loan amortization spreadsheet excel sheet can be one of the best tools in applying for a loan. The one you create with excel can help in the process of preparing an accurate estimate, financing options and pricing.

Amortization is the process of paying off one’s existing debt with new debt. This new debt usually comes from new money. However, all of the credit debts and other liabilities have to be paid at the end of each period.

It’s also very important to make sure that the monthly payments are affordable and well within your means. If you try to buy a car without having enough money to buy it, then chances are you won’t be able to pay for it when you are in a financial bind.

Using an Auto Loan Amortization Spreadsheet to Save Time and Money

Loan amortization is an automated accounting process that allows for the calculation of the costs of borrowing. This calculation takes into account how much each installment is, what you will owe in total, your income, and the interest rate you will be charged.

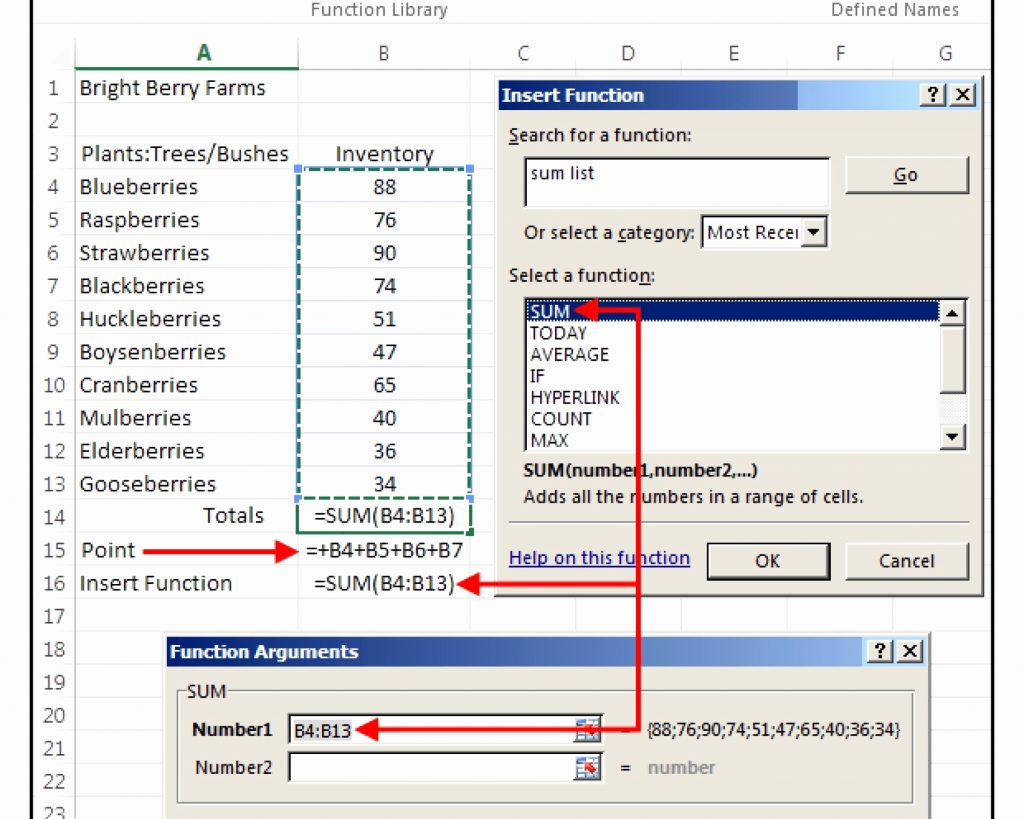

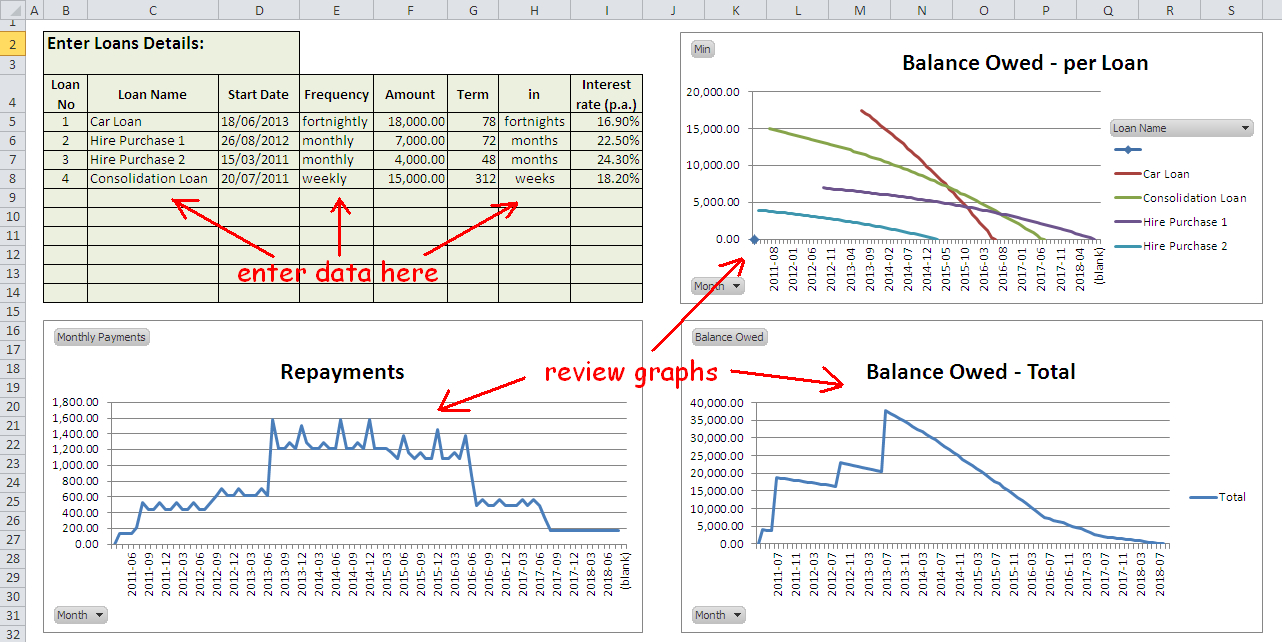

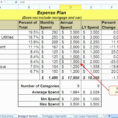

By dividing this amount by the initial payment and applying interest, you end up with an amortization chart. These charts are the basis of the lending company calculating whether or not you will qualify for a loan.

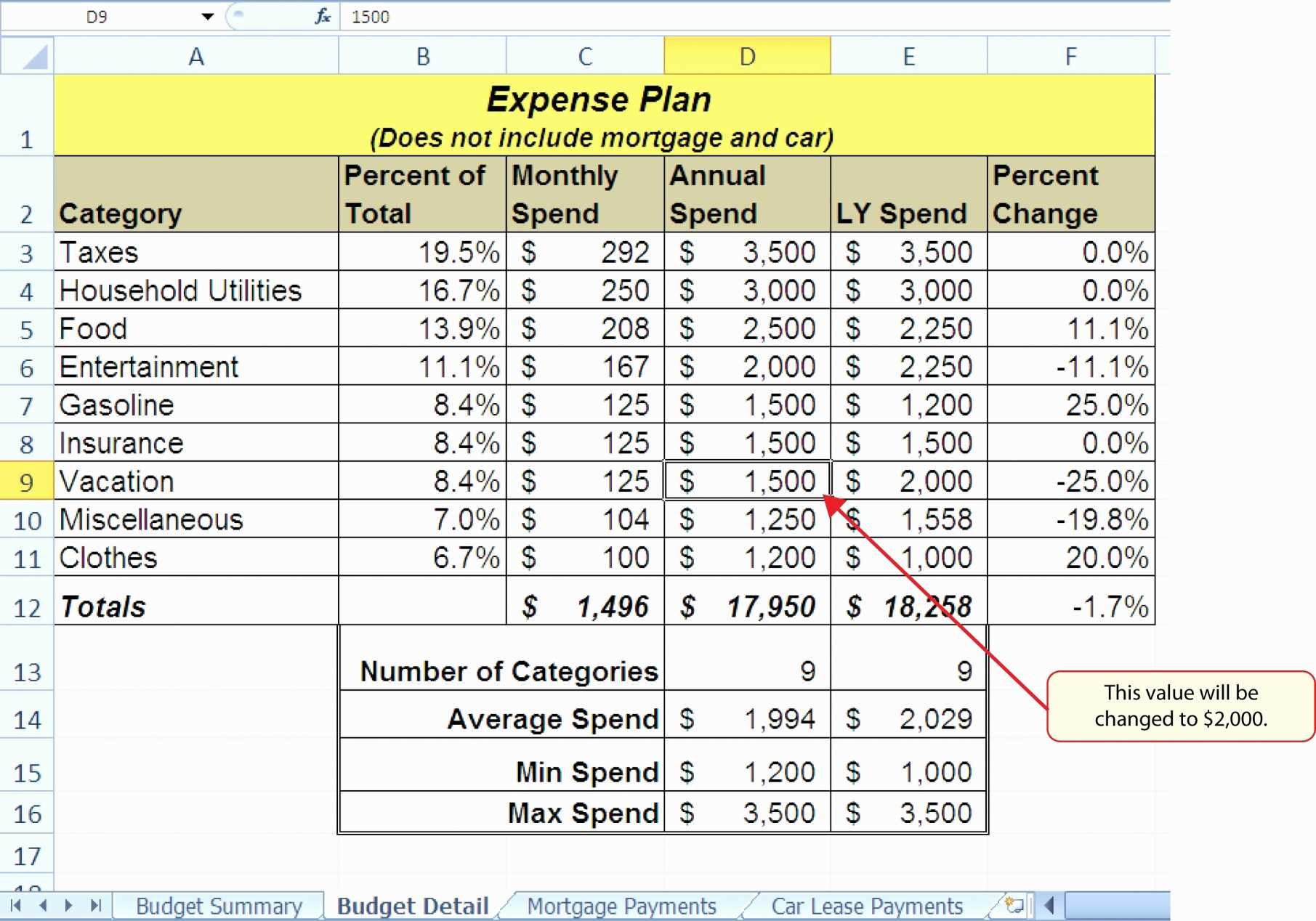

By making a loan amortization spreadsheet, you have the ability to see exactly how much you can afford to borrow and still pay it off. There is no guessing involved because it is based on actual accounts.

As well as a loan amortization spreadsheet, there are many other forms of auto loans available to you. These include used car loans, used truck loans, and even used auto financing. There are so many different types of loans available that it can get quite confusing.

Lenders use this information to determine whether or not you have the money for the loan. They will base their decision on how much you have in the bank account, how much you can reasonably afford to pay each month, and your credit rating.

The good news is that this doesn’t necessarily mean that you won’t be able to afford the amount of payments that are required to pay off the loan. In fact, if you make regular payments on time, your lender may actually pay you more than the original amount that you borrowed.

If you have a car that has a high credit value, you might have a better chance of qualifying for a loan when compared to someone who has only a low credit score. However, if you don’t, it’s likely that the amount you will pay each month will be more expensive than if you had a good credit rating.

If you have trouble keeping up with the payments, maybe you can use an auto loan amortization spreadsheet to help you out. Although this isn’t the way to go about getting the loan, it can be a useful tool that can make the process easier for you. LOOK ALSO : capstone sales forecast spreadsheet