How To Use A Business Expense Deduction Form

There are many business expense deductions that can be claimed by businesses. The information provided below will help you make a claim for your business. It may not seem like the easiest thing in the world to do, but it is a fact that it is better to take responsibility than to have business being unable to make a claim because of it being too difficult.

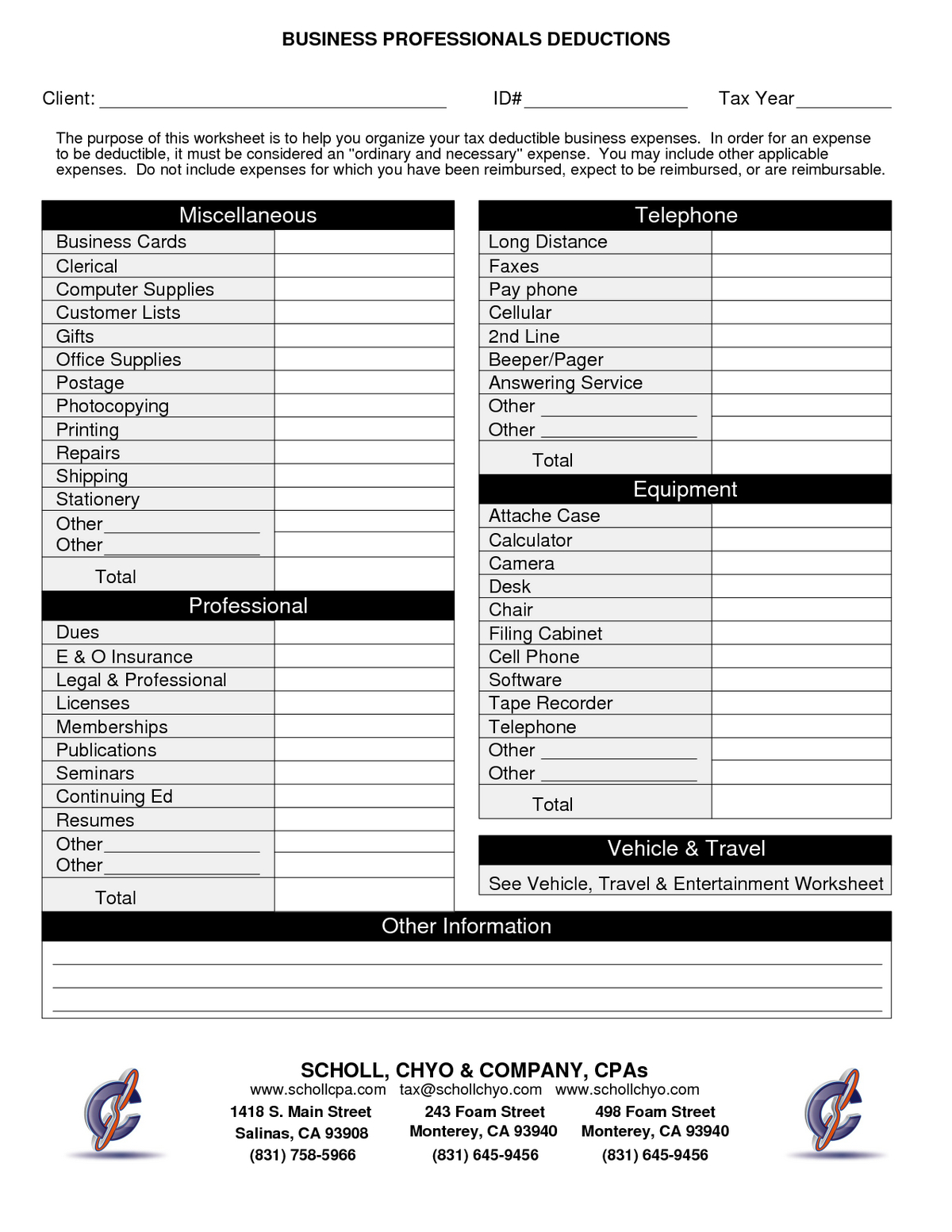

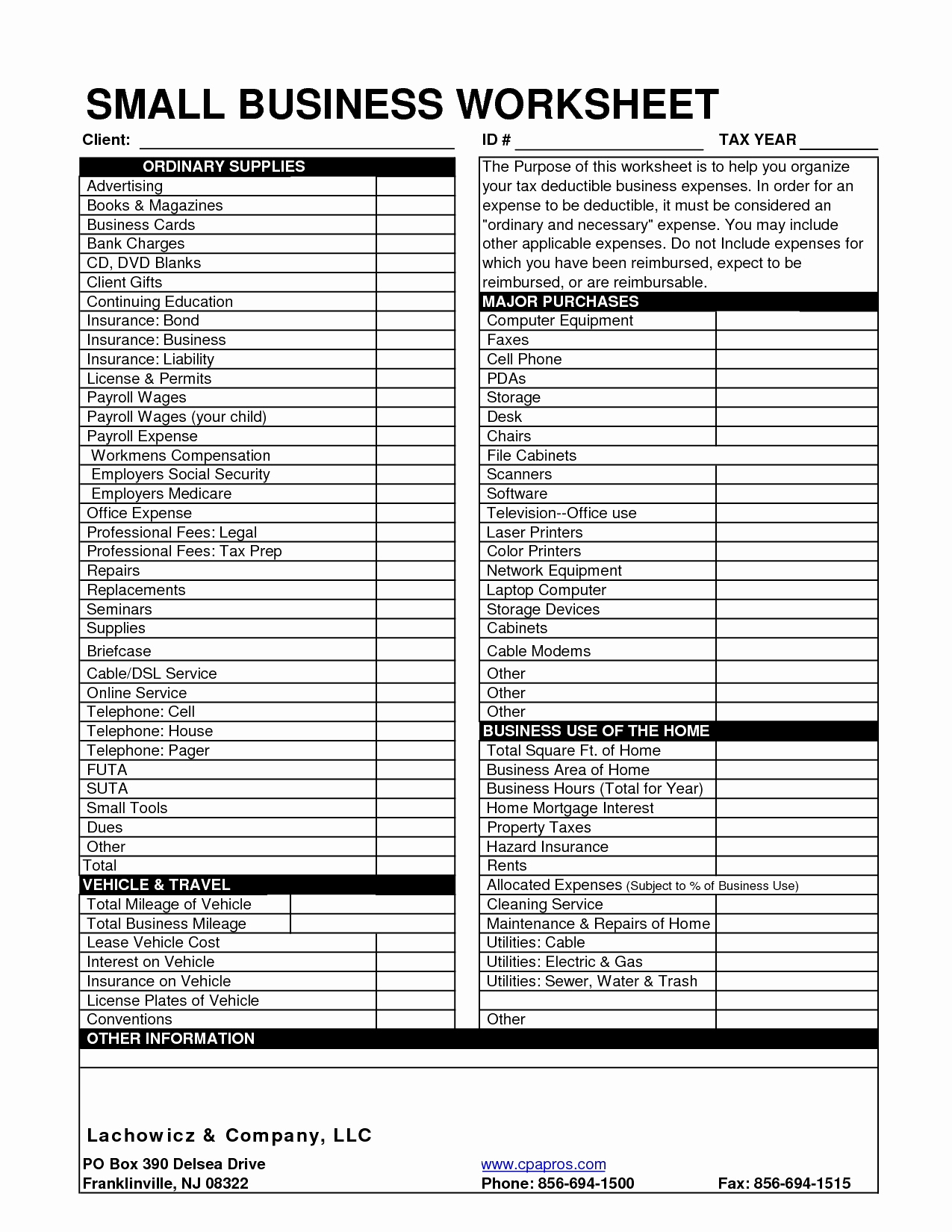

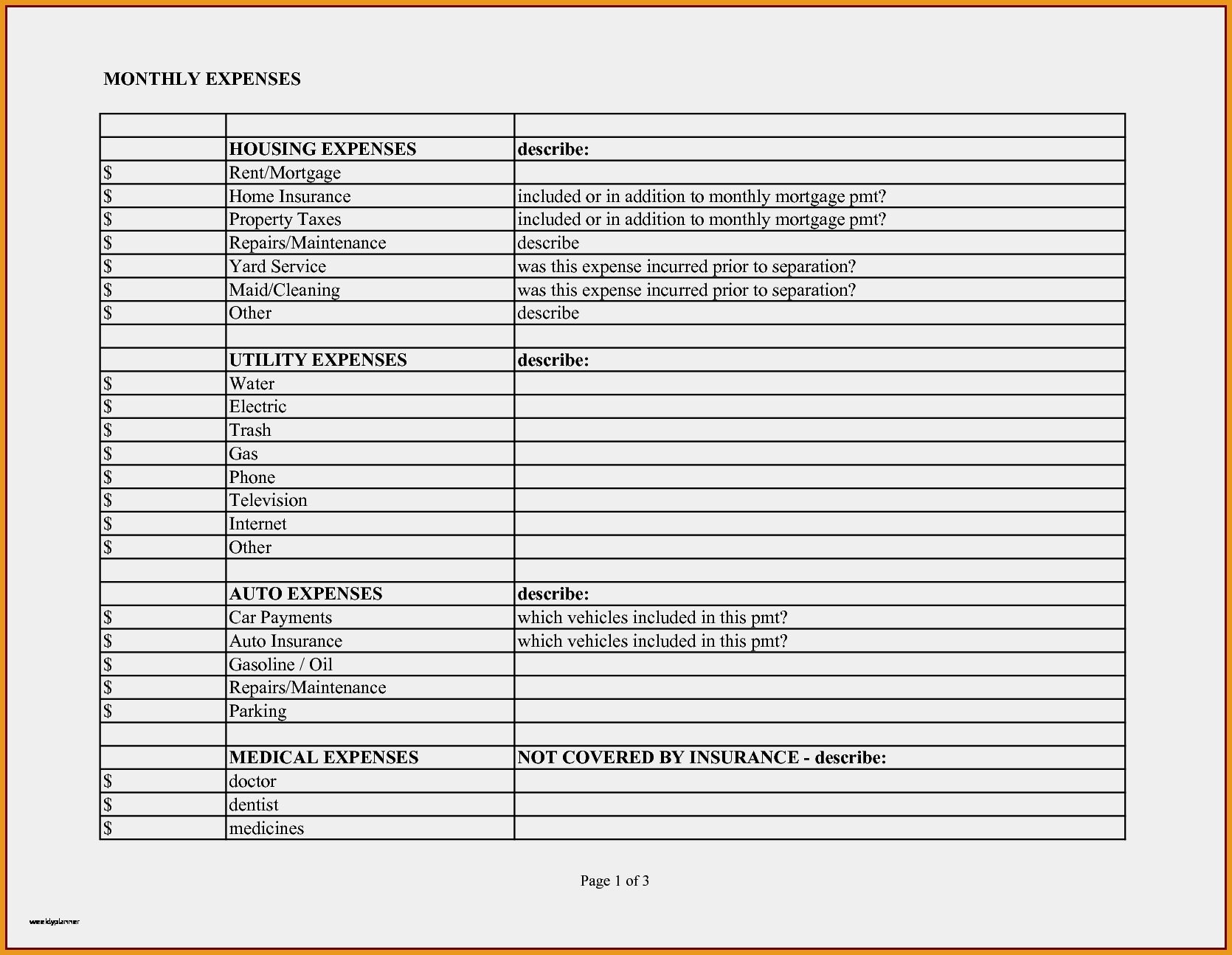

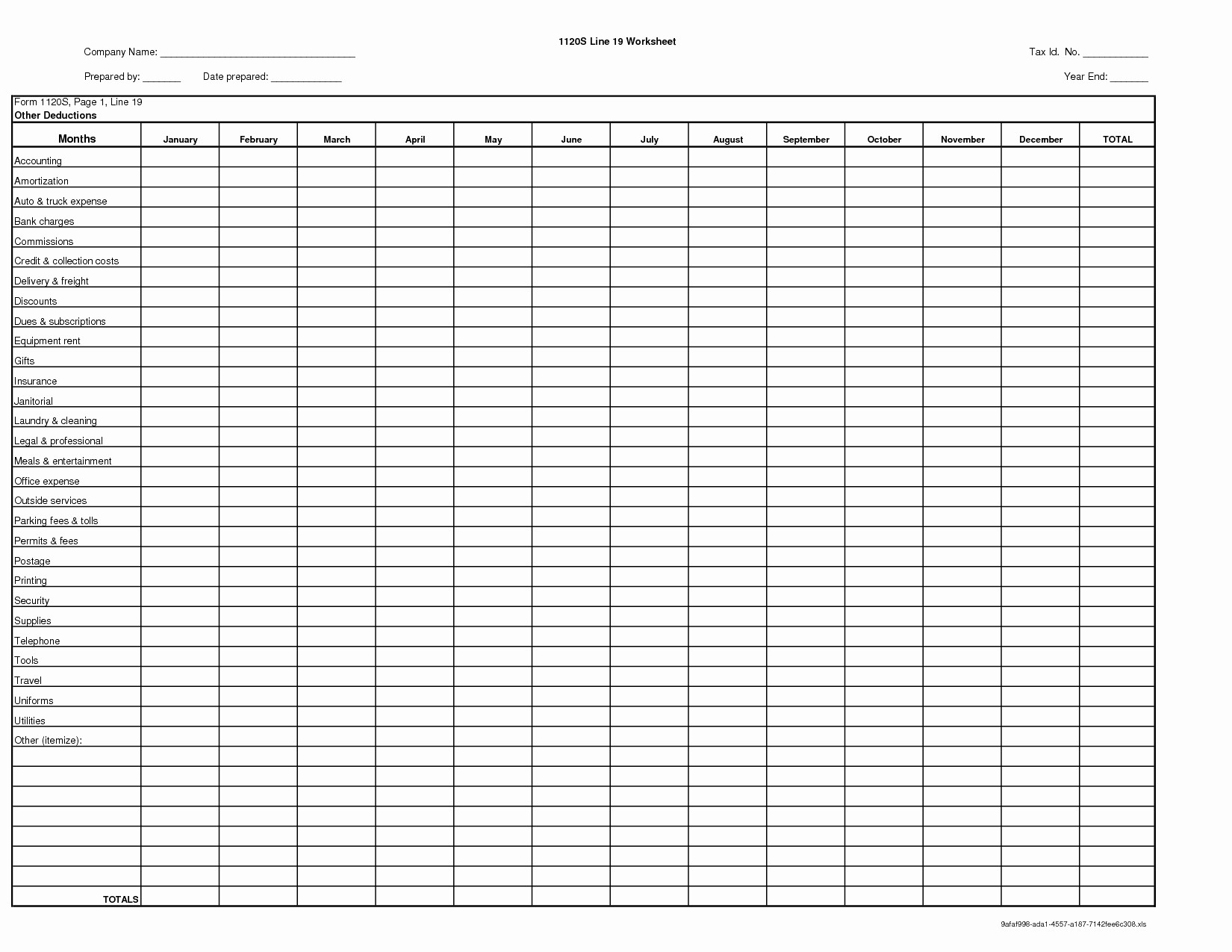

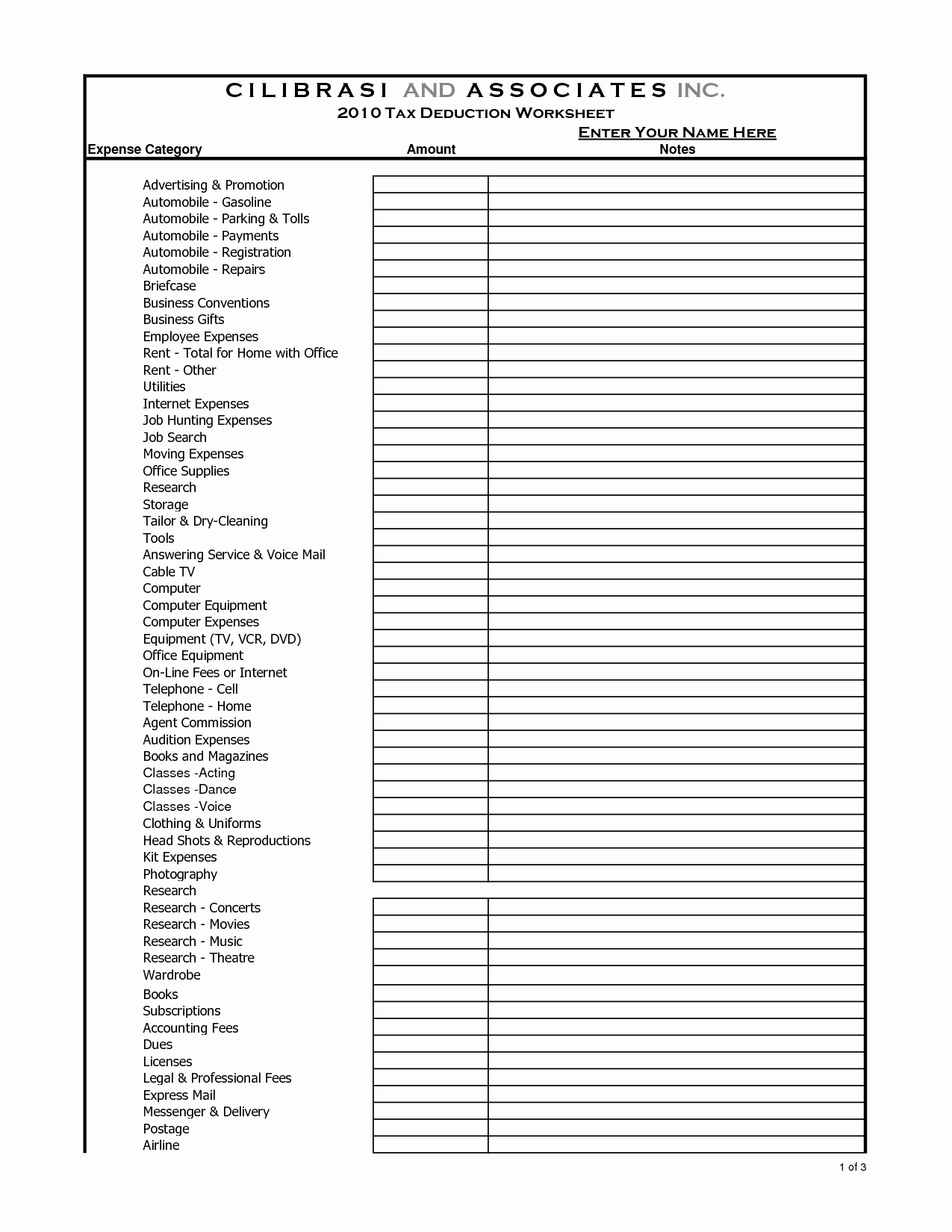

The spreadsheet that can be used to claim for business expense deductions can be found by searching on Google. Some sites will have templates available for you to use to help you fill in the form. This is important because it allows you to avoid filling in all the forms yourself. This spreadsheet is easily available and you could use it to claim the expenses you can see.

The spreadsheet will let you see all the different ways that can be claimed for business expense deductions. As you may know, all of these are perfectly legal as long as you know the correct format.

Many of the documents used to process your tax return are also legal as long as they include all the important details such as your income, your tax payable, and your expenses. It is important to look at the tax section of your tax return to see if there are any expenses that you can claim for.

These are called the fringe benefits and the information will be based on the total expenditure or goods or services that you purchased for your business. These are not allowed to be claimed as a deduction.

One of the most common tax deduction that you can claim is the capital expense. This is used to calculate what your business has spent money on since the start of your business.

A common deduction is your business’s work expense. This means the expenses that your business has incurred but was able to get credit for against your tax return.

If you have your own business expense to the claim, the spreadsheet will give you some valuable information. The expenses are broken down into regular expenses, special events, interest charges, and any additional sources of income.

Since some companies will only write off a percentage of the business expense, you will need to find out exactly how much you can claim. The spreadsheet will allow you to do this.

Make sure that you calculate your business expense before you spend it on the product or service that you offer. This is vital so that you don’t over spend.

It is essential that you calculate your business expense and start claiming your expenses as soon as possible. This will save you time and money as well as help your business to get more profits. YOU MUST READ : business expense categories spreadsheet