Bookkeeping For Self Employed

There are several aspects to bookkeeping for self employed spreadsheet. They include bookkeeping for small business owners, business owners and job owners.

A business owner is able to ensure that he/she is free from all forms of violation and harassment in case of a written agreement (also known as an Audit Trail) between the owner and the accountant for the payroll system or the accounting system. To ensure the quality of transactions in any business, the owner should write down all the details of transactions and all the payments made to him/her personally. Any business owner should keep a record of all cash transactions.

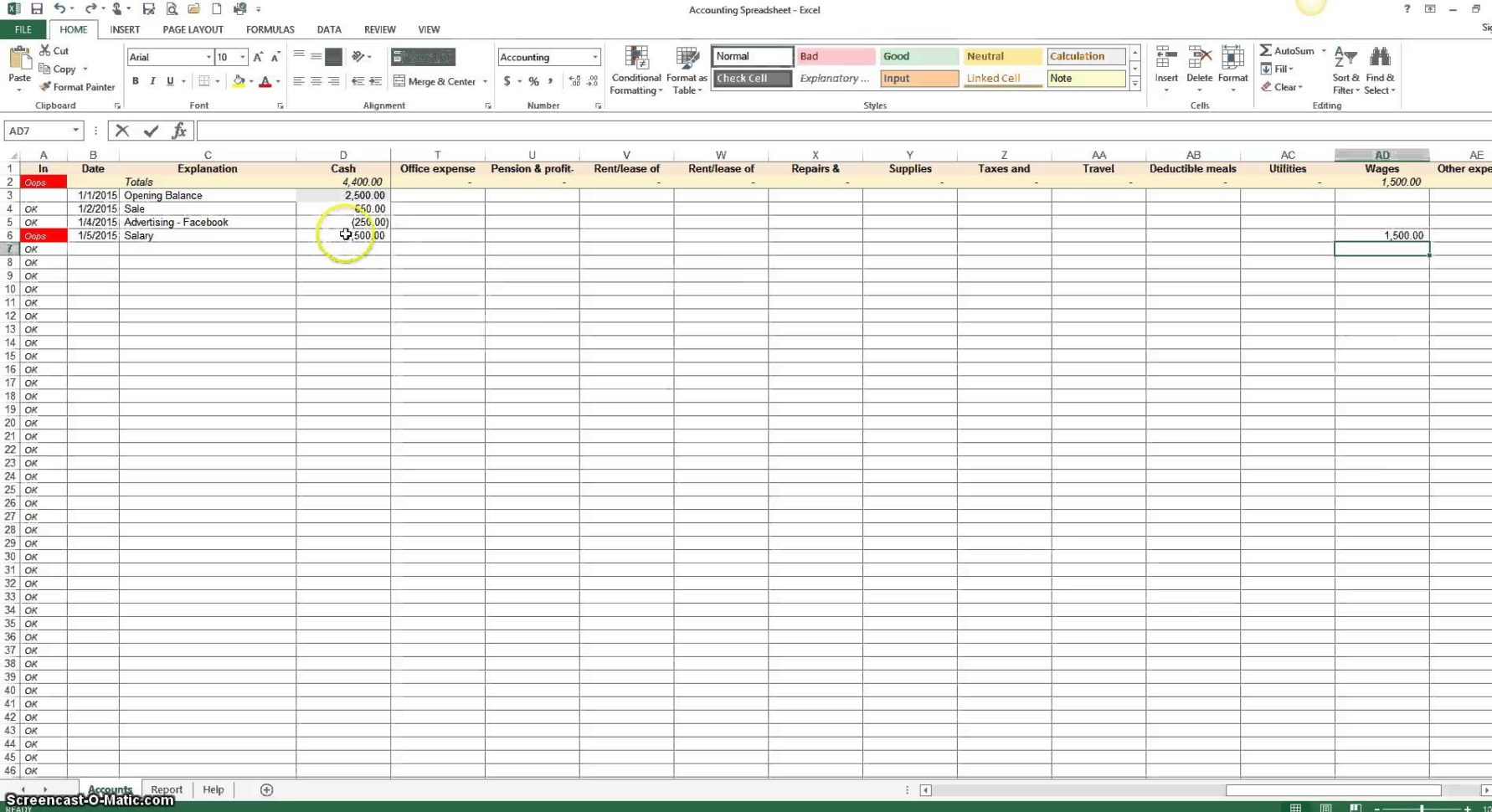

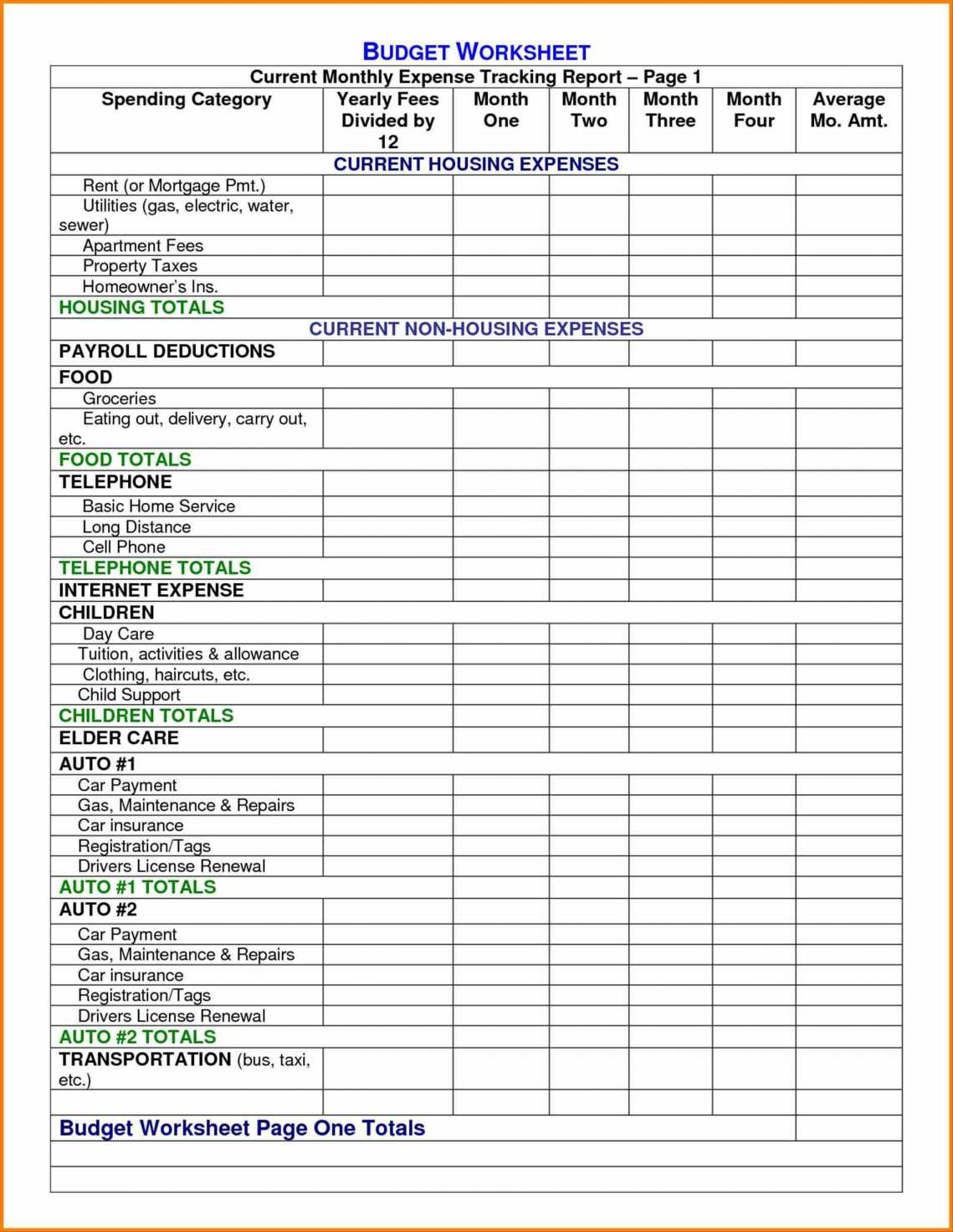

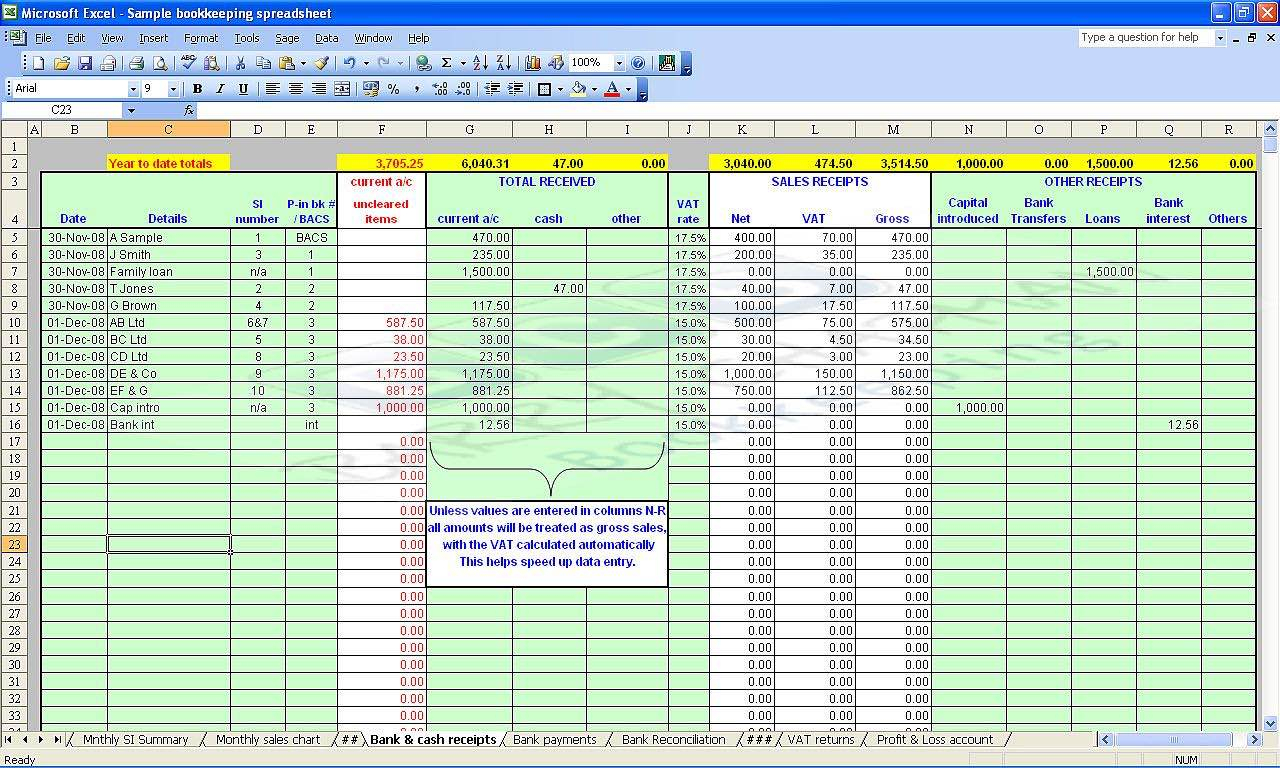

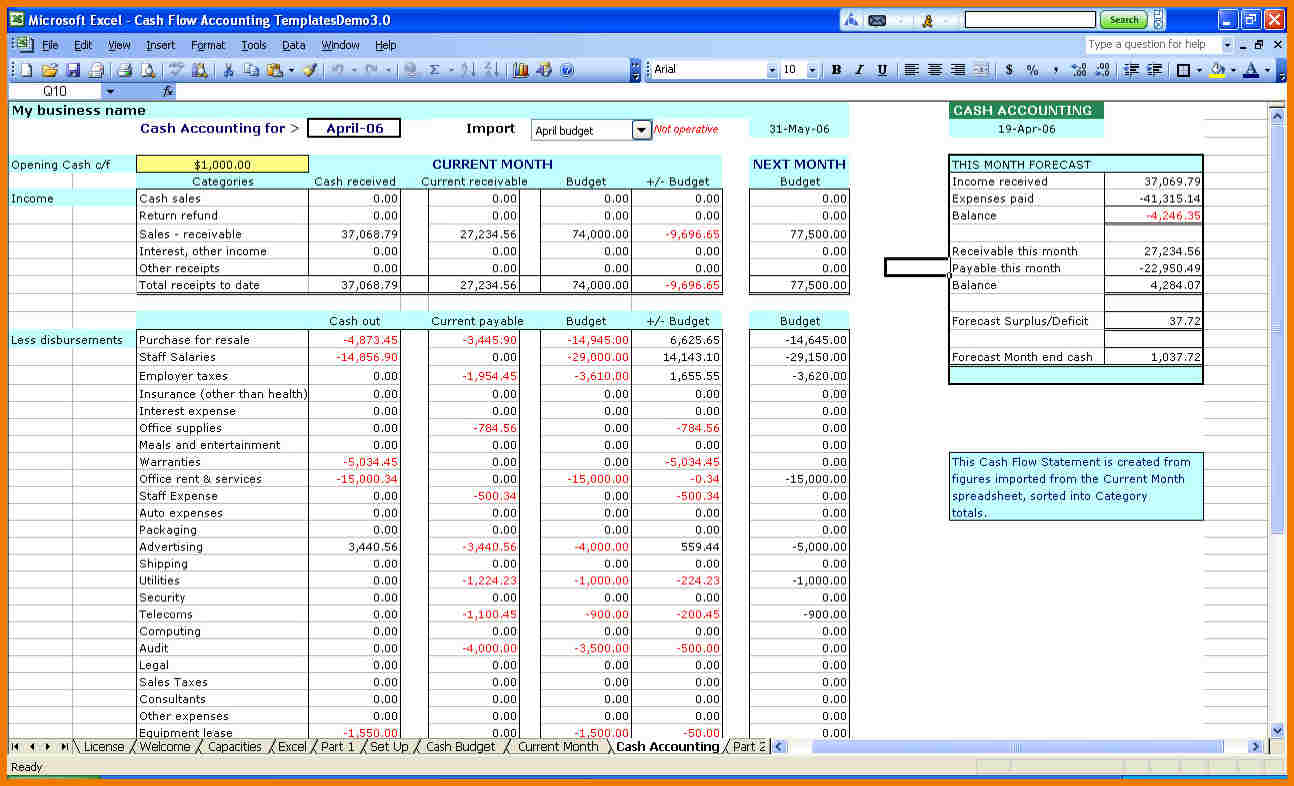

A small business owner can use this to keep track of the cash receipts and expenditure. The accounting and bookkeeping for small business owners include records, transactions, receipts, expenses, inventories, taxes, refunds, invoices, tax liability and expense, customer payments, cash out, employee-notification, credit card payments, payment vouchers, debit cards and check payments. All these activities can be handled with the help of some bookkeeping software.

The payroll or the accounting for payer is a process that has been around for ages. The need for effective reporting, organization, and control has existed since the beginning of time. Today, the automated accounting for payroll has really taken a leap forward. It makes it possible for an employer to provide a single record of all his employees at any given point of time.

A direct approach of showing the financial statements for one’s business really helps in showing the direction of a business. One can ask for a spreadsheet that will contain all the payment data as well as the balance sheet as well as the income statement. This kind of setup is particularly used by small businesses. For job owners, there are many business managers who understand the importance of manual filing, reconciliation, and invoice to send out as well as receive payment.

These books will help you in making your books as accurate as possible. By writing down all the information that is required in order to prepare accounts, they will assist you in making regular reports to show the growth and progress of your business. They are very helpful to the owners of small businesses especially the ones who have difficulties in filing their taxes.

Bookkeeping for small business owners provides the facility of maintaining record keeping and reporting all the information about business, sales, profits, expenditures, taxes, items received and expenses. It also provides a tracking mechanism for the bookkeeping. The bookkeeping for small business owners has become very important in the recent times due to the increasing number of financial institutions, regulators, governments, and agencies. It provides assurance for both small businesses and job owners.

It can be viewed as a game changer because it provides the facility of manual record keeping, reconciliation, item management, and reporting. The data in the bookkeeping system can be exported into different formats. The reports that can be generated by using bookkeeping software can be easily distributed, shared, and distributed to other users in case of business organizations. Manual data entry can also be a great help for them.

With the increased emphasis on manual record keeping, the cost of administration has decreased drastically. The better hand held devices, such as mobile phones, have also made it possible for small business owners to see, download, and manage their financial records. These devices are designed to be simple to use.

Bookkeeping for small business owners can be a serious investment for many businesses that believe in delivering consistent, clean, professional results. They are providing the system to ensure that taxes are paid and payments are made to customers.

Payroll is an excellent accounting tool for any business that can streamline the finances and decrease the risks for them. It can also serve as a security measure against fraud. that will prevent theft of information. READ ALSO : blood sugar spreadsheet