In order to generate a bond ladder spreadsheet, you need to know a little bit about your bonds. Make sure that the bonds you want to look at are backed by a government or some kind of legal entity. Don’t forget that government bonds are always backed by the government. You can see your requirements on the bond page of your local financial firm.

If you have a free account with a money market fund, I recommend that you check the bonds of the majority of those funds. The majority of these funds have both mortgage-backed securities and corporate bonds.

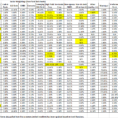

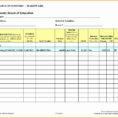

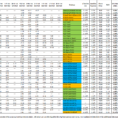

After you get a free bond spreadsheet for this loan, it’s time to work on your spreadsheets. The spreadsheet is going to need a heading, a column, and a list. Each column will be one bond (or one security). Any time you encounter a column, make sure that you put the bonds at the top of the list so that you know where to begin looking.

How to Use Bond Ladder Sheets

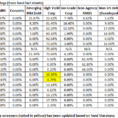

In each of the lists, you’ll see the bonds in descending order by the ratings. What’s going to happen is that you’re going to be identifying which bonds you have the most interest in (or more interest in) by simply looking at the name. This method is the most accurate and will bring you the highest rating.

As I said before, the bonds will be going in descending order by the rating. Look at your ratings, which I found to be pretty easy because I had a good understanding of what each rating represented. If you don’t, have a look at the quotes from the government websites for bonds and watch for any indication of future inflation or economic cycles.

The last step is to decide how much money you’re going to get out of the loan. This can be done in many ways, but I have found that the easiest wayis to look at the graph of the market value of the bonds. Take the market value that would buy what you want to get out of the loan and divide it by the number of years left on the loan. That is how much you’re going to get out of the loan.

Most people simply use the current market value and that’s a fair way to go about it. Then you just multiply that amount by the number of years to get the amount you want to get out of the loan. You don’t have to worry about breaking even; you can easily make a profit if you take this approach.

You can do the same thing for the interest rate as well. If you just use the current market value and subtract that number from the number of years left, you’ll get a fairly accurate number for the interest rate.

Before you get started on your spreadsheet, go through your ratings again and review them one more time. You may have to look at them multiple times in order to really get the most from them. Take some notes of things that you don’t like.

Then you’re going to need to put a table of values across the top. This is where you put the values for your bonds. You have to make sure that they have exact dollar amounts, but they should be equal in value. Don’t worry about making sure that your values are consistent.

In the end, you’re going to use the bond ladder spreadsheet to give you a rating of which bonds you want to get. The purpose of using the bond ladder spreadsheet is to help you understand what bonds you have available and why. PLEASE SEE : boma 2010 excel spreadsheet